The rise of Lithium Iron Phosphate batteries in Europe?

12.09.2024

The global race for dominance in electric vehicle battery production has intensified, with Europe making strategic moves to catch up with China's lead.

As the shift towards e-mobility has slowed down, the choice of battery technology plays a crucial role in determining the cost, performance, and sustainability of electric vehicles.

How will battery production in Europe develop?

As the shift towards e-mobility has slowed down, the choice of battery technology plays a crucial role in determining the cost, performance, and sustainability of electric vehicles.

How will battery production in Europe develop?

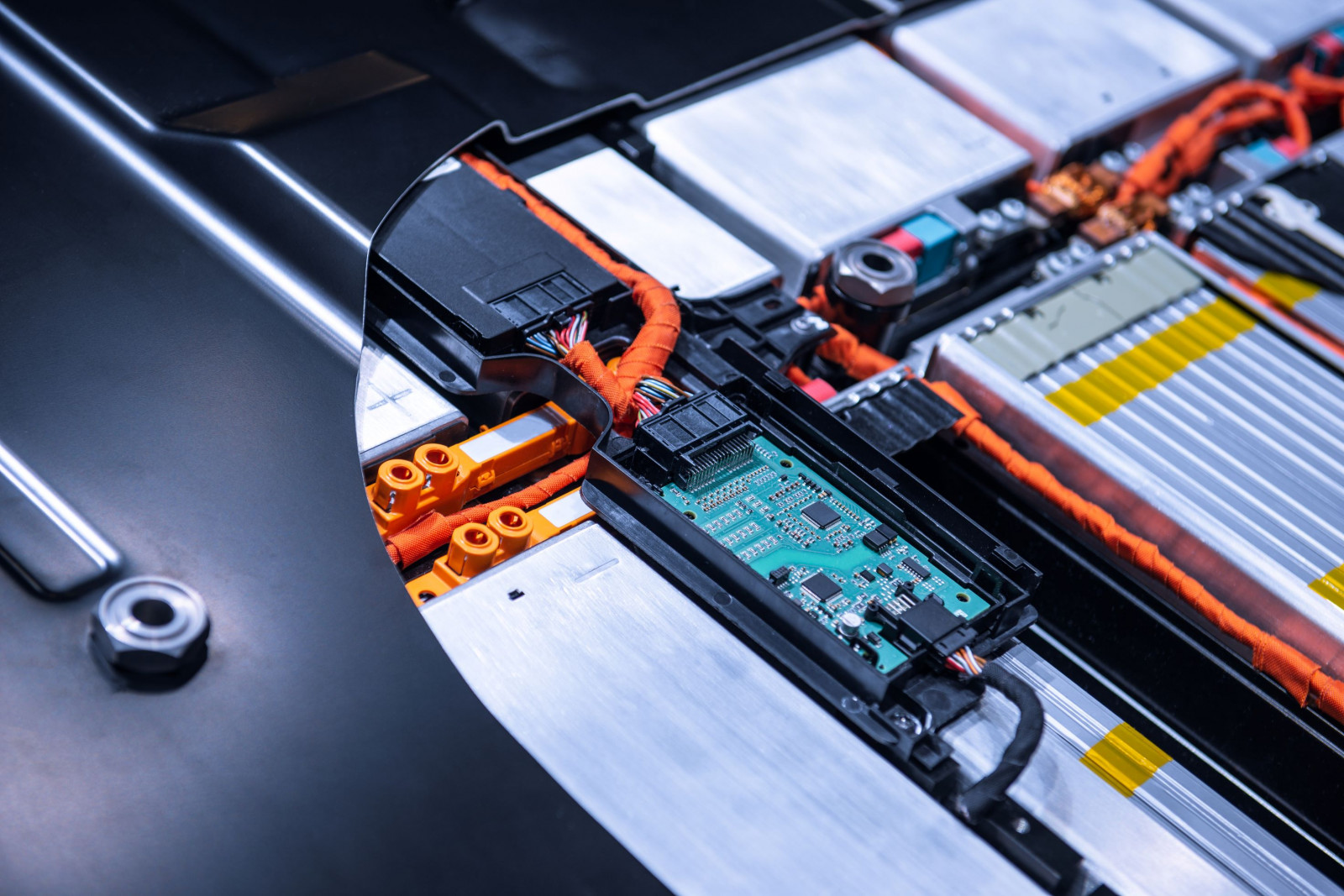

Why LFP batteries might be the solutionEurope is aiming to catch up with China in battery production by building its own large-scale battery production capacities. The initial focus was on cost-intensive nickel-manganese-cobalt (NMC) batteries as they offer the highest capacities. However, in the recent past the demand for electric vehicles has cooled significantly. Main reason is the high price, especially of European e-vehicles. Accordingly, reducing costs is the most important goal of European car makers. One promising way is to also focus on lithium iron phosphate (LFP) batteries and - ramp up local production. Although LFP batteries have a slightly lower energy storage capacity compared to NMC batteries, LFP batteries offer further advantages due to their high stability, lower risk of overheating incidents and long charge/discharge cycles at significantly lower prices. Therefore, LFP is the ideal solution for low- to mid-tier cars. In addition to their use in electric vehicles, LFP batteries are also used in the field of stationary batteries. For example, LFP batteries are predominantly used as local storage in combination with photovoltaics due to its lower price and high cycle stability. In addition, energy density does not play a major role in stationary batteries.

Emerging LFP developmentsIn the future, LFP batteries can be expected to receive significant investment in Europe for both electric vehicles and stationary energy storage. At the same time, the entire battery production supply chain will adapt as key chemicals like iron phosphate and conductive carbon need to grow along, offering many opportunities. Strong investments in localized LFP production are expected to reduce reliance on Asian suppliers and to strengthen the region’s battery value chain. The European value chain is currently extended also into neighboring countries, i.e. Morocco. While there are no relevant natural sources of Phosphate in Europe, Morocco is one of the largest suppliers of Phosphate. Additionally, the low electricity costs from photovoltaic would allow for very cost competitive production of LFP raw materials.

The fact that multiple projects for LFP raw materials are under construction and even a project planned for Spain has been relocated to Morocco shows that it is becoming a reality. However, huge overcapacities of battery materials in China, delayed construction of battery cell plants in Europe and cooled demand for e-vehicles, lead to unhealthy low prices. Consequently, the question is if the anticipated and much needed local European supply chain for LFP battery material will indeed materialize. This can only be the case if a strategic approach will prevail over the short-term chase for the lowest prices by importing LFP batteries form China.Are you interested in further information? Please do not hesitate to contact us: Thorsten Leupold

Phone number +49 6201 9915 16

Thorsten.Leupold@schlegelundpartner.deAhmad Sisouno

Phone number +49 6201 9915 18

Ahmad.Sisouno@schlegelundpartner.de© Schlegel und Partner 2024

Emerging LFP developmentsIn the future, LFP batteries can be expected to receive significant investment in Europe for both electric vehicles and stationary energy storage. At the same time, the entire battery production supply chain will adapt as key chemicals like iron phosphate and conductive carbon need to grow along, offering many opportunities. Strong investments in localized LFP production are expected to reduce reliance on Asian suppliers and to strengthen the region’s battery value chain. The European value chain is currently extended also into neighboring countries, i.e. Morocco. While there are no relevant natural sources of Phosphate in Europe, Morocco is one of the largest suppliers of Phosphate. Additionally, the low electricity costs from photovoltaic would allow for very cost competitive production of LFP raw materials.

The fact that multiple projects for LFP raw materials are under construction and even a project planned for Spain has been relocated to Morocco shows that it is becoming a reality. However, huge overcapacities of battery materials in China, delayed construction of battery cell plants in Europe and cooled demand for e-vehicles, lead to unhealthy low prices. Consequently, the question is if the anticipated and much needed local European supply chain for LFP battery material will indeed materialize. This can only be the case if a strategic approach will prevail over the short-term chase for the lowest prices by importing LFP batteries form China.Are you interested in further information? Please do not hesitate to contact us: Thorsten Leupold

Phone number +49 6201 9915 16

Thorsten.Leupold@schlegelundpartner.deAhmad Sisouno

Phone number +49 6201 9915 18

Ahmad.Sisouno@schlegelundpartner.de© Schlegel und Partner 2024